By Affiliate Vanessa Duchman of Glass Jacobson

The Markets

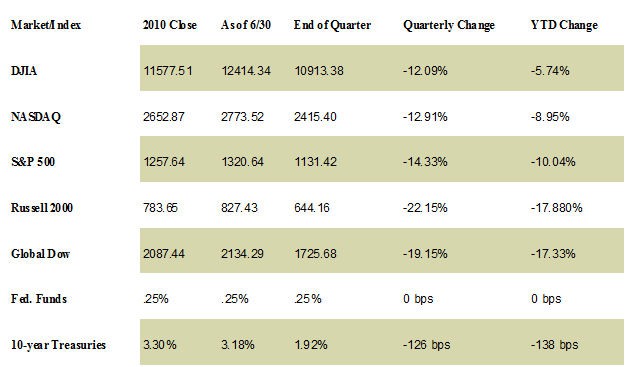

It was a roller-coaster quarter for equities, as weeks and even days when the Dow swung several hundred points in both directions seemed to become commonplace. By the end, the volatility had cost the Dow almost 15% since its April high. The small caps of the Russell 2000 suffered the most; by the end of the quarter the index had lost roughly a quarter of its value since April, putting it in bear-market territory. The S&P 500 lost 17% in the same time, while the Nasdaq has declined almost 16% since April. The Global Dow continued to slump under the weight of concerns about the global impact of eurozone debt problems.

The deficit/debt ceiling debacle was eventually overshadowed by debt issues abroad. Despite Standard and Poor’s downgrade of the U.S. credit rating, demand from nervous investors sent Treasuries soaring, pushing yields on the 10-year note below 2% to levels not seen in decades. Gold benefitted from the anxiety for a while, hitting a new record just under $1,900 an ounce before plummeting below $1,700 in September as the dollar strengthened against the euro. After surpassing $100 a barrel, oil prices dropped back to around $80 on fears of the potential for renewed global recession. Other commodities also were hit at quarter’s end.

Quarterly Economic Perspective

- The world continued to worry about the possibility of global contagion from European debt problems. European leaders agreed to a second bailout for Greece, though individual member nations must agree to participate. However, problems began spreading to the larger economies of Spain and Italy, which saw their borrowing costs rise as investors feared that the European Financial Stability Facility wouldn’t be able to bail them out. Despite Greece’s attempts to balance its budget, at the end of the quarter it was still unclear whether the new measures would enable the country to qualify for its October round of assistance.

- The final estimate of U.S. economic growth during the second quarter was 1.3%. That’s slightly higher than the Bureau of Economic Analysis’s previous 1% estimate, and an improvement from Q1’s 0.4%.

- Unemployment remained stalled at 9.1%, according to the Bureau of Labor Statistics.

- Citing concerns about “significant downside risks to the economic outlook,” the Federal Reserve announced it will sell $400 billion worth of short-term bonds in its portfolio and buy an equal amount of longer maturities. The plan, which echoes a 1960s maneuver called Operation Twist, also will involve reinvesting principal payments on the Fed’s agency debt holdings in agency mortgage-backed securities.

- The last-minute resolution of the debt ceiling debate couldn’t prevent Standard & Poor’s downgrade of the U.S. credit rating (and ratings of various agencies linked to the federal government) from an impeccable AAA to AA+. Two other ratings agencies are watching to see what further measures are taken to tackle the deficit, including proposals from a “supercommittee” charged with finding at least $1.2 trillion in additional deficit reduction.

Data source: All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Past performance is no guarantee of future results. Equities data reflects price changes, not total return.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. Market indexes listed are unmanaged and are not available for direct investment.