By Laura Rodini, Executive Director, The Historic Charles Street Association

By Laura Rodini, Executive Director, The Historic Charles Street Association

Who couldn’t use a little extra money these days?

There’s a program funded by the City of Baltimore that I bet you haven’t heard about.

But it could mean the difference of thousands of dollars to your business.

Am I serious? You bet! I just spent the morning speaking with Todd Dolbin and Richard Escalante of The Baltimore Development Corp (BDC). The BDC is Baltimore City’s economic development agency.

Every year, they help hundreds of businesses in Baltimore on a range of services, “from parking issues to building a Convention Center Hotel,” says Richard.

One of their main initiatives is to help businesses understand the tax incentives within Baltimore City. “We do a lot of outreach,” Todd said.

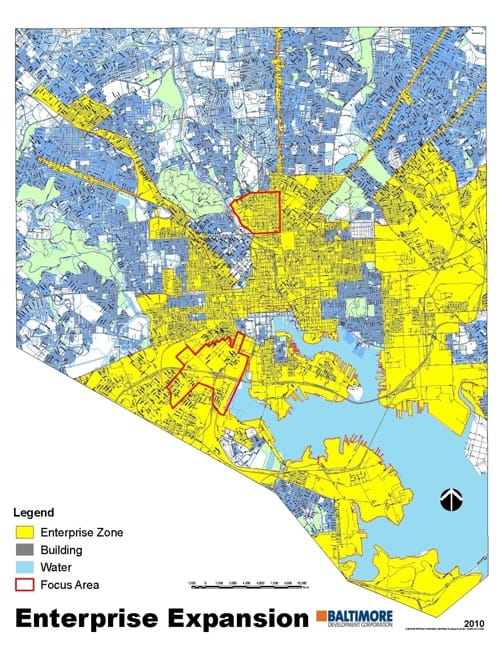

See this map? We folks here on Charles Street (and surrounding streets) are part of something called an Enterprise Zone in Baltimore City.

This means that the city gives tax breaks to businesses who are located in the yellow area.

Why? “Because the city wants to keep our downtown thriving,” Todd explained.

As a business owner on Charles Street, there are three specific programs you can benefit from.

#1 Money For Your Business: Income Tax Credits

In the past year, have you hired a full-time employee who works more than 35 hours per week?

Does this person make 150% above minimum wage (at least $10.82)?

If you answered yes to both, you are eligible for a $1,000 tax credit. And it’s not a one-time thing – you can make $1,000 for each new employee you hire for a period of up to three years!

The application seriously takes 5 minutes to fill out (I looked it over myself), and someone from the Baltimore Development Corp.’s office is available to answer any questions about it. They can even file it on your behalf with the state of Maryland.

Even if you haven’t hired anyone this year, you may still get $$. Existing employees can receive a retroactive tax credit as far back as three years ago (2009)!

In order to receive the retroactive credit, all you’d have to do is fill out the Baltimore Development Corp’s application for the tax credit, and then refile the 500CR Form on your income taxes. It takes about a week to hear back from the BDC with your certification letter.

“For people looking at the bottom line,” Richard said, “This is a credit they may not be aware of.”

#2 Money For Your Business: Real Property Tax Credits

Here’s another question: Have you purchased a building on Charles Street? Have you put any money into improving it? If you have, you could be eligible for property tax credits – saving you tens of thousands of dollars over a 10-year period!

Say you bought a building for $1,000 and put another $1,000 into improving it. Your new tax assessment would go from $1k to $2k, right?

Well, under the BDC’s program, you pay the original, assessed value of the building, plus 20% of the new assessment for the next five years. Following that, your assessment rate would increase by 10% every year until the 10th year, when you’d pay the full price of the new tax assessment.

That’s quite a nice break!

“A lot of people don’t know that you only need to fill out a simple application to receive these credits,” Richard said.

“It doesn’t take a lot of time. Not doing this is like lost money,” he added.

#3 Money For Your Business: The ‘One Maryland’ Tax Credit

The third and final way you could be eligible for some cold, hard cash from the City of Baltimore is in the form of The One Maryland Tax Credit program. Baltimore City is one of nine jurisdictions in the entire state that qualify for this program.

This program appeals to those who have a little more funds to invest, but it’s worth mentioning nonetheless. Say you’re a new company to the state of Maryland or an existing company that can create 25 new jobs over a 2-year period. If you invest a minimum of $500,000 or a maximum of $5.5 million, you can actually get your initial investment back over a 15-year period!

How? It all has to do with withholding taxes.

“We want to meet with companies on Charles Street, see what they’re planning and how we can help,” Richard added. And he means it. One of the most notable examples of a business that has received assistance from the BDC is Lenny’s Deli.

“Lenny’s was looking to expand,” Richard said. So the BDC helped them scout out locations. And even though the spot they chose (in Harborplace) wasn’t part of the Enterprise Zone, the BDC was still able to help.

The BDC secured a low-interest loan for Lenny’s, and, through a partnership with the Mayor’s Office for Economic Development, they sent Lenny’s pre-screened job candidates with the experience they were looking for.

“It doesn’t matter the size of your company – we are here to help.” Richard said.

As a small business owner myself, Richard and his team have pointed me in a valuable direction that’s helping to take my business to the next level.

But don’t take my word for it. Contact Richard and Todd today to find out what you are eligible for. And don’t leave any money on the table. In this difficult economic age, we need all of the help we can get!

The Baltimore Development Corp. is located at 36 S. Charles Street, Suite 16. Richard can be reached at 410-779-3882 and Todd can be reached at 410-779-3838 or through their website: www.baltimoredevelopment.com