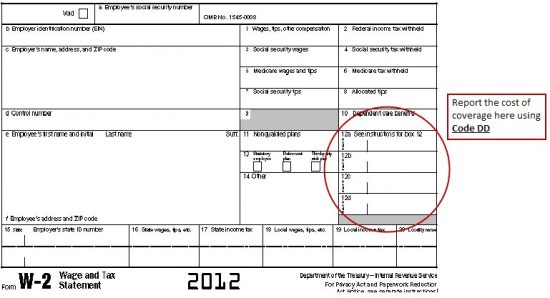

As tax time draws near, it’s important to know about some major legislative updates that may affect you, your business and your employees. According to a post made by BenefitMall (and sent to us from MyCity4Her subscriber Suzanne Thompson of HealthPlan Headquarters), certain employers must report the cost of health care coverage provided under an employer-sponsored group health plan on employees’ W-2 forms as of January 1, 2013. This requirement became effective as of January 1, 2012 but was deferred by making the requirement optional for employee’s Tax Year 2011 W-2 forms. The requirement is now effective for employee Tax Year 2012 W-2 forms that will be issued in 2013.

Here are some of the key questions and answers from the Legislative Alert which provides detailed information on this new requirement stemming from the Patient Protection and Affordable Care Act (PPACA).

What legal statute mandates this requirement? PPACA Section 9002 amended Section 6051(a) of the Internal Revenue Code to require certain employers to track health care costs on employees’ W-2 forms.

Does an employer have to report the cost of coverage on its employees’ W-2 forms? Under PPACA, employers that provide applicable employer-sponsored group health plan coverage must report the cost of this coverage on an employee’s W-2.

Applicable employer-sponsored coverage is defined as coverage under any group health plan made available to the employee by an employer, which is excludable from the employee’s gross income under section 106 of the Internal Revenue Code, or would be so excludable if it were employer-provided coverage.

This requirement applies to:

- Businesses

- Tax-exempt organizations

- Federal, state and local government entities (except with respect to plans maintained primarily for members of the military and their families)

- Churches and religious organizations

- Employers that are not subject to the COBRA continuation coverage requirement

This requirement does not apply to:

- Federally recognized Indian tribal governments

- Any tribally chartered corporation wholly owned by a federally recognized Indian tribal government

In some cases, the reporting obligations are optional for employers. For example:

- Employers that filed fewer than 250 W-2 forms for the preceding calendar year

- In this case, the employee must be provided a W-2 within 30 days; however, the employer is not required to report any amount

- The employee is terminated before the end of a calendar year but requests, in writing, a W-2 form before the end of the year

- The W-2 is provided by third-party sick-pay provider to employees of other employers

What types of coverage must the employer report? An employer is not required to issue a W-2 solely to report the value of health care coverage for retirees or other employees, or former employees, if the employer would not otherwise provide a W-2.

However, if a W-2 is being issued for an employee, the following types of coverage must be reported:

- Major medical

- Health FSA value for the plan year in excess of employee’s cafeteria plan salary reductions for all qualified benefits

- Hospital indemnity or specified illness (insured or self-funded), paid on after-tax basis

- Employee Assistance Plan (EAP) providing applicable employer-sponsored health care coverage (Note: this is required only if the employer charges a COBRA premium)

- On-site medical clinics providing applicable employer-sponsored health care coverage (Note: this is required only if the employer charges a COBRA premium)

- Wellness programs providing applicable employer-sponsored health care coverage (Note: this is required only if the employer charges a COBRA premium

The following types of coverage do not have to be reported:

- Health FSA funded solely by salary-reduction amounts

- HSA contributions (employer or employee)

- Archer MSA contributions (employer or employee)

- Hospital indemnity or specified illness (insured or self-funded) paid on after-tax basis

- Government plans providing coverage primarily for members of the military and their families

- Federally recognized Indian tribal government plans and plans of tribally charted corporations wholly owned by a federally recognized Indian tribal government

- Accident or disability income

- Long-term care

- Liability insurance

- Supplemental liability insurance

- Workers’ compensation

- Automobile medical payment insurance

- Credit-only insurance

- Excess reimbursement to highly compensated individual, included in gross income

- Payment/reimbursement of health insurance premiums for 2% shareholder-employee, included in gross income

Reporting the following types of coverage is optional:

- Dental or vision plan not integrated into another medical or health plan

- Dental or vision plan that gives the choice of declining or electing and paying an additional premium

- HRA contributions

- Employee Assistance Plan (EAP) providing applicable employer sponsored health care coverage (Note: this is optional only if the employer does not charge a COBRA premium)

- On-site medical clinics providing applicable employer-sponsored health care coverage (Note: this is optional only if the employer does not charge a COBRA premium)

- Wellness programs providing applicable employer-sponsored health care coverage (Note: this is optional only if the employer does not charge a COBRA premium)

- Self-funded plans not subject to federal COBRA

For more questions and answers on how to report health care costs on an employee’s W-2, visit BenefitMall.com.